Few diseases can threaten a member’s well-being and put a benefits plan to the test like cancer. When the dreaded diagnosis comes, will you and your plan be ready?

Maybe no diagnosis looms over consumers and employers quite like cancer. For any one of us, it is life-altering. For self-insured employers, it means a valued colleague’s productivity and sense of security are put to the test.

The implications don’t end there. A survey of large employers by Business Group on Health found that cancer is one of the top two conditions driving employers’ healthcare costs. Further, the National Cancer Institute reports that nearly half of cancer diagnoses in adults happen during peak employment years (20-64 years old).

For HR leaders and benefits consultants, it’s a matter of how much and how often — not whether — cancer will challenge your carefully designed benefits plan. Factor in the fast pace of cancer research and treatment innovations and defining a robust member-first cancer benefit becomes a moving target.

Insights from the front line

To help inform your decision-making, we recently surveyed our front-line Care Coordinators and clinical teams to learn which benefits and services are most valuable for members on cancer journeys.

Quantum Health Care Coordinators provide healthcare navigation and clinical support to more than 1.7 million members and are involved at the very beginning and throughout members’ cancer journeys. This uniquely positions our team to see which benefits are most helpful to consumers, and where benefits plans sometimes come up short.

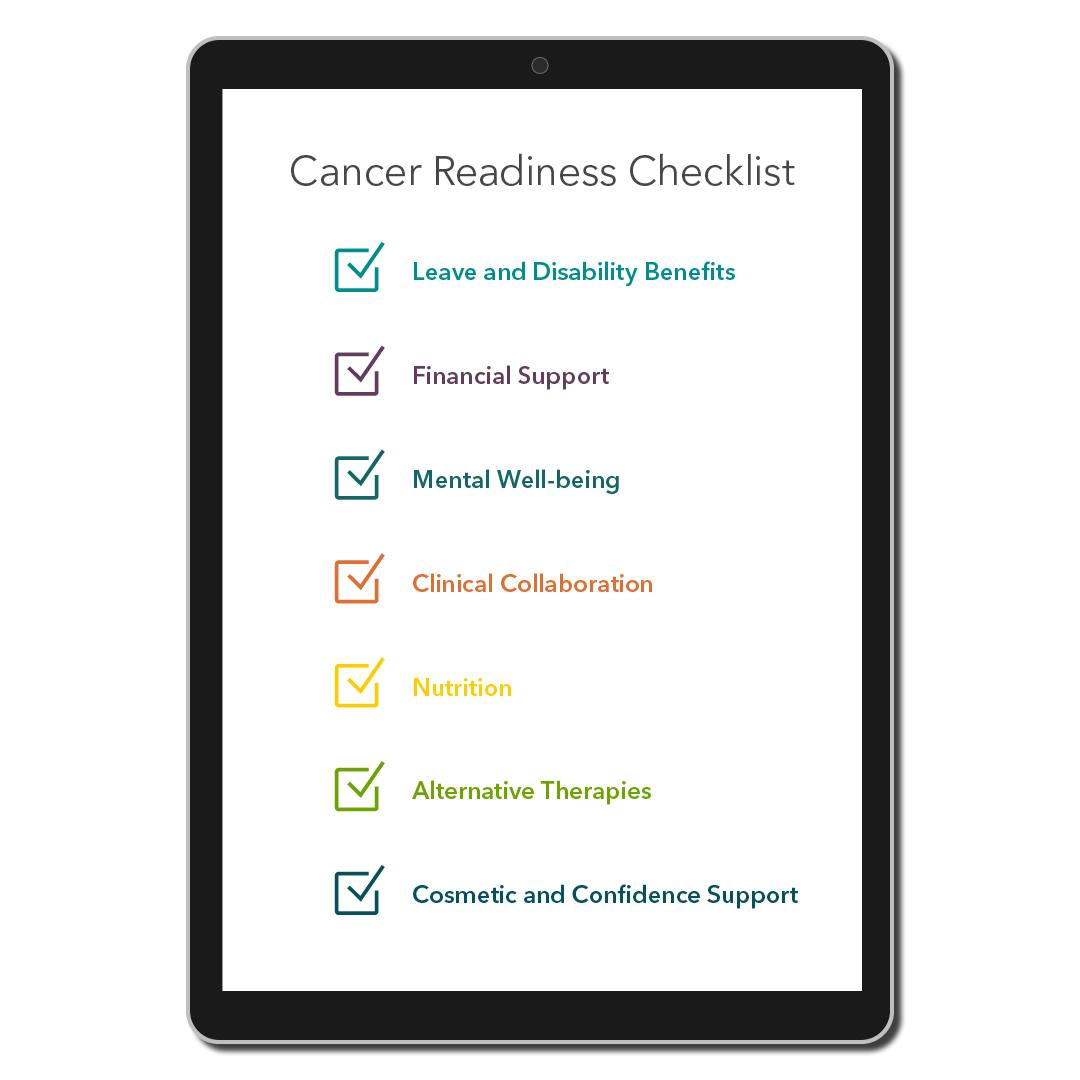

This learning based on experience can serve as a “readiness checklist” as you decide whether — and how — you might want to enhance coverage for cancer-related treatment and services.

- Leave and Disability Benefits: The predictable income and job security that come with short- and long-term disability benefits, plus the Family and Medical Leave Act, offer peace of mind for employees and their dependents on cancer journeys. Once these benefits are in your plan, they will still be unfamiliar to most members. You’ll want a member services partner that is proactive in educating and providing guidance, especially when a member’s cancer diagnosis is causing them information overload and emotional distress.

- Financial Support: A Duke University study found that cancer patients spent 11% of their household income on treatment-related costs. Consumers are considered underinsured when more than 10% of their income goes to healthcare. This means a valued employee with cancer can quickly find themselves in a dire situation. Fortunately, a variety of useful employer- and employee-paid financial benefits can help. Critical illness benefits can be employer-paid as part of core coverage available to all members, with payouts for critical diagnoses (like cancer) to help with the associated costs. Optional indemnity insurance, available for purchase by employees, can also help consumers with high medical costs through lump-sum payouts. Encouraging participation in flexible spending accounts (FSAs) and health savings accounts (HSAs) can help employees make the most of their funds when it comes to bridging financial gaps.

- Mental Well-Being: Cancer’s emotional toll can be severe. The good news? Many employers already offer a valuable benefit: an employee assistance program (EAP). Educating members about the support their EAP offers is key to its utilization. Adding tele-mental health options could be another step forward for your plan. An effective healthcare navigation partner will help drive utilization of these benefits.

- Clinical Collaboration: Increasingly, employers are adding second opinion or Centers of Excellence (COE) services to their plans. While they require investment, these solutions can lead to treatment plans that improve a member’s prognosis, enhance quality of life during treatment, shorten treatment duration, and reduce total cost. Quantum Health offers a precision cancer treatment solution that connects members and their doctors with world-renowned cancer researchers. In 80% of cases, consultation with a cancer expert leads to a new and potentially more effective course of treatment.

- Nutrition: Some cancer treatments, like radiation, can damage taste buds. Add to that side effects like vomiting and fatigue, and nutrition can suffer. Employers and consultants can explore solutions to address these issues, including lifestyle coaching that helps members set nutritional goals, or services that provide support from oncology dieticians and nurses.

- Alternative Therapies: Side effects can be devastating during cancer treatment. While therapies such as acupuncture, massage and aquatic therapy are not a cure, they may help members manage symptoms in ways not possible through traditional medicine. Written into a plan, these benefits typically provide for a set number of allowed visits per year.

- Cosmetic and Confidence Support: A recovering member may have just completed treatment, but she no longer recognizes herself in the mirror. Hair loss is a common side effect, which is why benefits that cover a “cranial prosthesis” (i.e., a wig) will be valued by members. (This is typically written as a fixed-dollar benefit.) Also, being educated on using HSA dollars to purchase eligible mastectomy bras can help members with breast cancer regain a sense of self.

Caring and guidance beyond the benefits plan

Even the best plan can’t anticipate a member’s every need on a cancer journey. For example, if an employee’s appetite and strength improve through nutritional coaching, they may be able to continue working during treatment. But what if they can no longer drive to the office because of medications they’ve been prescribed?

Quantum Health’s navigation model includes researching an expanding array of community services and guiding plan members to them. While outside of their employer’s plan, these services can still offer significant physical, emotional or financial support. Examples include connecting members to free or discounted transportation services or food delivery services. Our Care Coordinators also find themselves frequently guiding members to education resources and local support groups offered by such organizations as the American Cancer Society and Gilda’s Club, a member of the global nonprofit cancer support group network Cancer Support Community.

Cancer is one of life’s harsh realities that too many people will face. But by proactively designing cancer benefits to align with your commitment to provide robust support for your employees, you’ll have taken steps to ensure that members will have a better, more cost-effective and supported experience.