From blind spots to breakthroughs: The new demands on healthcare navigation

Healthcare navigation has become central to how self-insured employers manage costs and support employees. Yet many consultants say the reporting and analytics behind these programs often fall short, leaving employers without a clear understanding of value. These consultants, who advise employers at the front lines, are increasingly vocal about their frustration with unclear, backward-looking data that fails to connect costs to measurable health outcomes.

According to the 2025 MedCity Benefit Consultant Sentiment Index, less than 30% of consultants say they rely on vendor reporting to make strategic recommendations. Most describe the insights as generic, with one consultant noting that reports “don’t tie costs back to specific program investments, making it difficult to assess ROI.”

This frustration points to a critical blind spot: navigation can’t deliver its full value unless employers have transparency into performance and clear evidence of return on investment.

Why employers are shifting to independent healthcare navigation

Employers are already acting on this gap. Two-thirds of consultants now recommend healthcare navigation solutions outside of traditional insurance carriers, most often turning to independent providers. Their reasons include:

- Better member experience

- Stronger clinical integration

- Greater clarity around ROI in healthcare

The survey also revealed a stark contrast between expectations and reality. While 100% of consultants believe that clinically embedded navigation models are important, only 12% think those models are currently delivering on that promise. Employers report gaps in personalization, care coordination and member engagement, signaling that some navigation programs are still falling short.

This is why the market is shifting toward independent, clinically integrated navigation models that embed care teams and deliver real-time analytics. By tying interventions directly to outcomes, these models not only improve member experience but also provide the transparency employers need to demonstrate value.

AI’s breakout moment in healthcare benefits

Alongside ROI transparency, the other story emerging from this year’s survey is the rapid adoption of artificial intelligence in benefits. Seventy-two percent of consultants now counsel clients on AI’s role in benefits programs, with nearly one-third advising on AI frequently or most of the time, a sharp increase from just 20% in 2024.

Once a trend, AI is now table stakes — with consultants pointing to its impact in three key areas:

- Reducing administrative burdens (52%)

- Supporting predictive analytics (43%)

- Enabling personalized decision support (44%)

Notably, 40% now cite AI’s ability to analyze member information and provide real-time answers for benefits administrators, up from 30% last year.

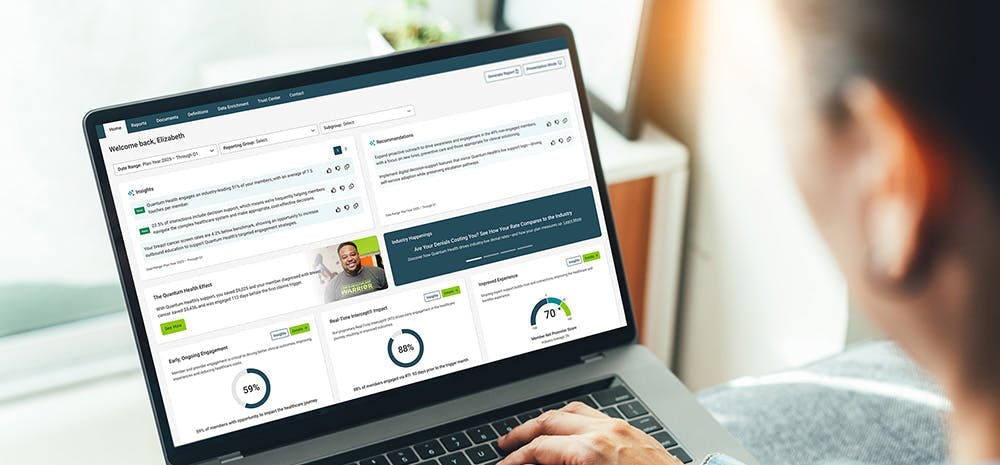

This signals a turning point. Employers expect navigation partners to move beyond static reporting to deliver predictive insights and proactive strategies. Retrospective claims summaries are no longer enough. Forecasts, benchmarks and actionable recommendations are now the standard.

The path forward: transparent, predictive and clinically integrated healthcare navigation

Together, these findings show navigation at a crossroads. Employers recognize the value in navigation but are demanding more. They want real-time reporting, clinically embedded care and AI-enabled insights that connect strategy to outcomes.

Forward-looking navigation models are already stepping into this space. By combining embedded care teams with advanced analytics and AI-driven risk detection, they are helping employers close gaps in care, forecast cost trends and deliver measurable value.

For self-insured employers and their consultants, the takeaway is clear: navigation can no longer operate in the dark. The blind spot around ROI and the lag in AI adoption are closing, but only for those willing to embrace models that deliver clarity, actionability and clinical depth.